An unusual imbalance between the supply and demand of homes for sale in the Twin Cities likely will lead to higher home prices some months from now, according to the Residential Real Estate Price Report Index, a monthly analysis of the 13-county metro area prepared by the Shenehon Center for Real Estate at the University of St. Thomas’ Opus College of Business.

“The lack of availability of homes for sale is likely to persist through the winter and into the spring of 2013,” said Herb Tousley, director of real estate programs at the university. “The imbalance between supply and demand … combined with historically low interest rates and an improving economy … will continue to put upward pressure on median sale prices.

“And as median sales prices continue to rise, more homes will be put up for sale as increasing values improve homeowners’ equity positions,” he predicted.

Here are some metro-area statistics that illustrate what is happening to the supply of homes:

- The number of homes for sale is the lowest in more than eight years. The number declined from 16,629 in September to 15,190 in October, and that compares to 21,348 homes listed in October 2011.

- The ratio of “homes for sale” compared to “closed sales” declined to 3.49 in October. That means for every home sold, there were 3.49 homes on the market. In October 2011 that ratio was 5.76 and in October 2010 it was 11.14.

- In October there was a 3.7-month supply of homes (and a 2.7-month supply for homes selling for less than $140,000). The normal supply is six to seven months.

- The shortage of homes is creating opportunities for new home builders. According to figures released by the Builders Association of the Twin Cities, permits for single-family construction in October have increased 46 percent over October 2011.

Tousley suggests a couple of reasons for the low supply of homes. Many homeowners are still underwater, meaning they owe more than their homes are worth. For some, rising prices could help fix that problem. There also are homeowners who would like to sell but they don’t have to sell right away; this group is sitting on the sidelines and waiting for prices to increase.

Meanwhile, here are signs of a continuing rebound on the “demand” side of the equation:

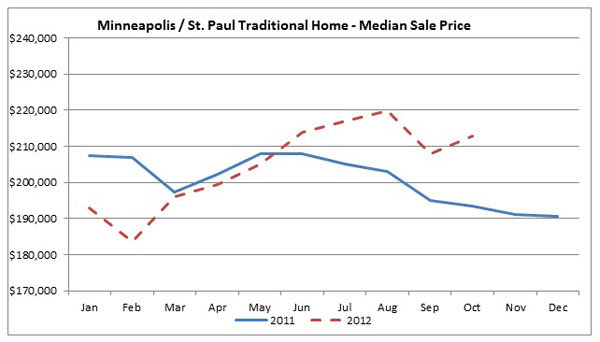

- The median price of a metro-area traditional-type sale (not a foreclosure or a short sale when a home is sold for a price less than the outstanding mortgage balance) increased 2.35 percent from September to October, from $207,875 to $212,750. It also is up 9.7 percent from October 2011.

- The number of closed sales increased from 4,054 in September to 4,355 in October, a gain of 7.4 percent.

- Both median prices and the number of closed sales are well above October 2011 levels.

- The number of pending sales in October was higher than September and October 2011.

- In addition to low interest rates, there are signs of an improving economy and higher levels of consumer confidence.

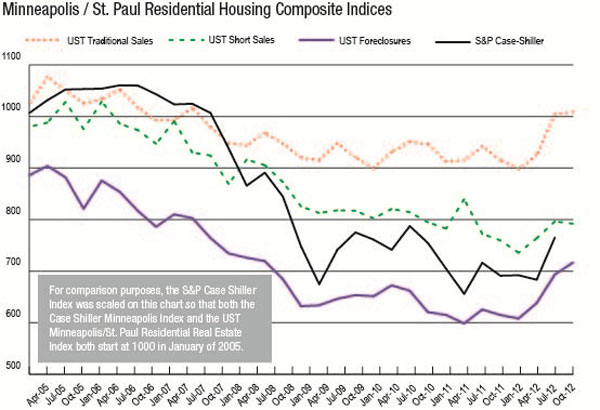

In addition to the sale price of homes throughout the Twin Cities, St. Thomas has developed a composite index that uses eight additional data elements to track the health of the traditional, foreclosure and short-sale markets.

The index for the foreclosure market showed the largest improvement. It moved from 703 in September to 717 in October. It has moved upward six months running and is up 16.6 percent over October 2011.

In October, 35.52 percent of sales that closed were distressed properties, compared to 46.19 percent in October 2011. While that’s good news, Tousley noted that before 2007, the rate of distressed sales was typically less than 5 percent.

One reason for the improvement in the foreclosure market is the increasing number of investors who are buying distressed properties, renovating them and either renting or selling them. “As the competition among investors increases, the median sale price of these properties is being driven upward,” Tousley said.

More details about the market can be found on the Shenehon Center’s website.

Research for the monthly reports is conducted by Tousley and Dr. Thomas Hamilton, associate professor of real estate at the university. The index is available free via email from Tousley at hwtousley1@stthomas.edu.