An analysis of Twin Cities real estate data for January shows that 2013 is off to a promising start. Researchers at the University of St. Thomas, however, are closely following an unusual quirk in the market: the low number of homes for sale.

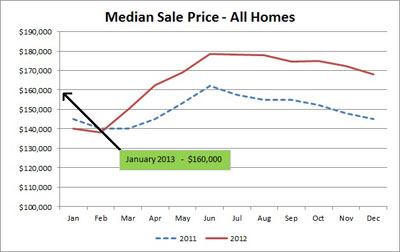

Home prices in January 2013 took an expected seasonal dip over the previous month; more importantly, they were up over January 2012, according to the Residential Real Estate Price Report Index, a monthly analysis of the 13-county metro area prepared by the Shenehon Center for Real Estate at St. Thomas’ Opus College of Business.

Home prices in January 2013 took an expected seasonal dip over the previous month; more importantly, they were up over January 2012, according to the Residential Real Estate Price Report Index, a monthly analysis of the 13-county metro area prepared by the Shenehon Center for Real Estate at St. Thomas’ Opus College of Business.

Each month the center tracks nine housing-market data elements, including the median price for three types of sales: nondistressed or traditional-type sales, foreclosures, and short sales (when a home is sold for less than the outstanding mortgage balance).

Herb Tousley, director of real estate programs at the university, said housing data from January 2013 “continues to exhibit many of the encouraging market trends that have been observed over the past 12 months.”

For January 2013:

- The median price of a traditional (nondistressed) home was $199,900, a decrease of 4.4 percent from December 2012 but up 3.6 percent from January 2012.

- The volume of sales was 2,797. That’s down 20 percent from December 2012 but up 11 percent from January 2012.

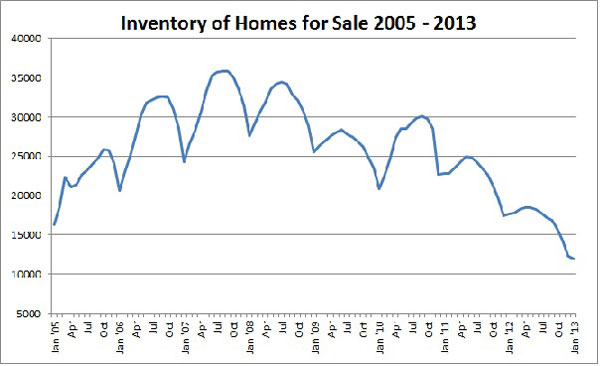

- The inventory of homes for sale keeps dropping. In January 2013 there were 11,977 homes for sale, which is 32 percent less than the 17,655 homes available in January 2012.

- The percentage of distressed sales (foreclosure and short sales) was 42.9 percent. That’s historically high, but down from 54.8 percent in January 2012 and 60.9 percent in January 2011.

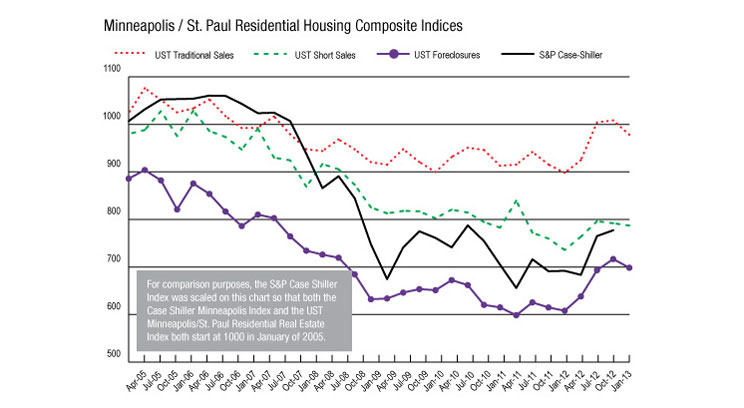

- St. Thomas’ composite index for January 2013, which uses nine data elements to measure the health of the market, is 9.1 percent higher than January 2012 for traditional sales. For foreclosure sales it is up 13.8 percent and for short sales it is up 6.8 percent.

Tousley said the market is progressing against the backdrop of the unusual shortage of homes for sale. To help track and understand the shortage, the Shenehon Center developed a ratio that compares the number of homes for sale in the Twin Cities to the number of homes sold.

In January 2013 there were only 4.28 homes for sale for every home sold, which is historically very low. In January 2012, the ratio was 6.8 homes for sale for every one sold. “Historically, in a balanced market the ratio typically falls between six and 10 homes for sale for every one sold,” Tousley said. “The good news for sellers is that as we move into the spring market more potential buyers will find a limited number of homes for sale which will put upward pressure on prices.”

Tousley suggests several reasons for the low ratio: “The fact remains that many homeowners are still underwater (they owe more than their home is worth) or have little equity in their homes; that, along with feelings of general economic uncertainty surrounding the federal government’s tax increases and budget cuts (the “sequester”) has kept many current and potential homeowners on the sidelines.

“Assuming the sequester issue is resolved favorably, housing prices should begin to increase causing homeowners’ equity positions to improve resulting in more sellers deciding to list their homes for sale.

“The low ratio of homes for sale, with increasing numbers of potential buyers, is beginning to positively change the dynamics of the housing market. In an increasing number of areas in the Twin Cities we are starting to see a shift from a buyer’s market to a seller’s market,” he said.

Tousley added that the shortage of homes on the market is creating opportunities for new-home builders, and single-family housing “starts” are showing modest increases compared to a year ago.

More details about the market can be found on the Shenehon Center’s website.

Research for the monthly reports is conducted by Tousley and Dr. Thomas Hamilton, associate professor of real estate at the university. The index is available free via email from Tousley at hwtousley1@stthomas.edu.