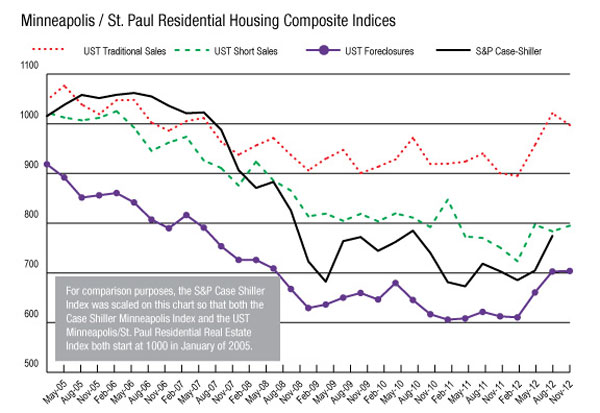

While both the median sale price and the number of closed sales dipped in the Twin Cities from October to November, the good news that in both cases the numbers are well above November 2011 levels, according to the Residential Real Estate Price Report Index, a monthly analysis of the 13-county metro area prepared by the Shenehon Center for Real Estate at the University of St. Thomas’ Opus College of Business.

Each month the center tracks nine housing-market data elements, including the median price for three types of sales: nondistressed or traditional-type sales, foreclosures, and short sales (when a home is sold for a price less than the outstanding mortgage balance).

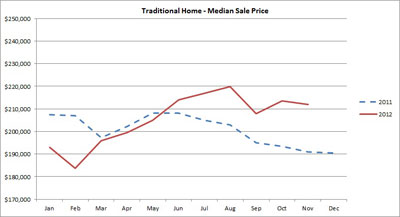

The median price of a nondistressed home in the Twin Cities in November was $211,995, up 10.99 percent from November 2011. And despite a tight supply of homes on the market, 2,479 of these nondistressed homes were sold in November, up 51 percent from November 2011; meanwhile, the number of pending sales in November was up 12.6 percent, an encouraging sign for December.

The median price of a nondistressed home in the Twin Cities in November was $211,995, up 10.99 percent from November 2011. And despite a tight supply of homes on the market, 2,479 of these nondistressed homes were sold in November, up 51 percent from November 2011; meanwhile, the number of pending sales in November was up 12.6 percent, an encouraging sign for December.

“The important thing to watch is the median sales price and the number of homes sold compared to the same period a year ago,” said Herb Tousley, director of real estate programs at the university. It is expected that both of these indicators will remain well above the levels recorded a year ago.

“If the trend continues through the winter and into the spring and summer of 2013, then we will have unquestionably turned the corner on a housing market that has been in decline since late in 2007. When that happens, the housing market will have assumed its more traditional role of helping to lead the way to economic recovery instead of being a drag on the economy,” he said.

Tousley said the increase in the number of homes sold this year is fueled by very low interest rates, an improving regional economy and higher levels of consumer confidence.

A characteristic of today’s housing market that stands out is the exceptionally low supply of homes for sale. That supply declined for the seventh-consecutive month and dropped from 15,487 in October to 13,875 in November. That’s a drop of 29.3 percent compared to a year ago.

The ratio of homes for sale compared to the number of closed sales, Tousley said, remains at “a very low” 3.55. That means for every home sold in November, there were 3.55 homes on the market. By comparison, the November 2011 ratio was 6.13. For moderately price homes – those under $200,000 – the ratio this past November was 2.0.

Tousley attributes the low ratio to at least two factors: a relatively high number of homeowners have negative equity (they owe more than their home is currently worth), and uncertainty about future economic conditions.

The situation, he predicts, will persist through the winter and spring of 2013 but in the end will lead to better days for the housing market. “The imbalance between the supply and demand of homes for sale, combined with historically low interest rates and a steady economy, will continue to put upward pressure on median sale prices. As median sale prices continue to rise, more homes will be put up for sale as increasing values improve homeowners’ equity positions.”

The percentage of distressed properties (foreclosures and short sales) represented 35.81 percent of all homes sold in the Twin Cities in November. That’s down from 48.65 percent in November of 2011. While it’s a marked improvement, Tousley notes that prior to 2007, the percentage of distressed sales was typically less than 5 percent.

An increasing number of investors are buying and renovating distressed properties, and then selling or renting them. As competition increases among investors for the smaller number of distressed properties, the median price of these properties is being driven upward.

More details about the market can be found on the Shenehon Center’s website.

Research for the monthly reports is conducted by Tousley and Dr. Thomas Hamilton, associate professor of real estate at the university. The index is available free via email from Tousley at hwtousley1@stthomas.edu.