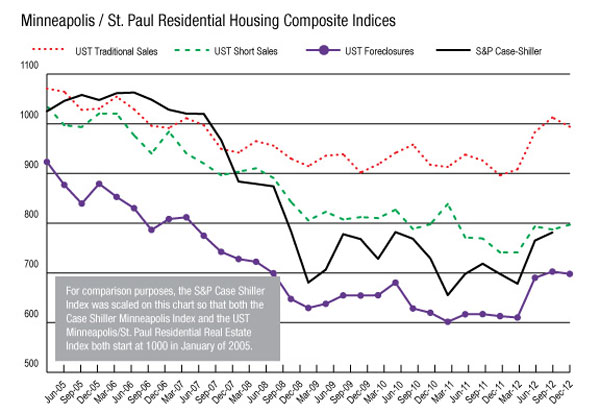

With data from December now in, history will record that 2012 was the year the Twin Cities housing market finally bottomed out and began to recover.

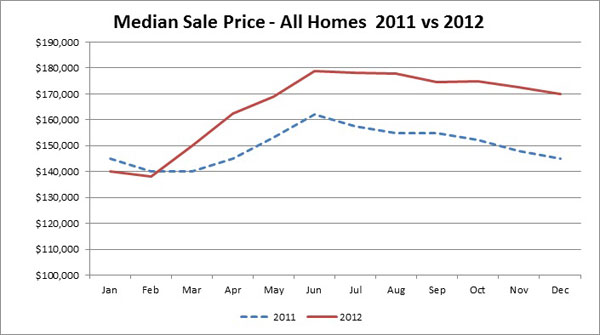

The market’s low point came in February 2012. Since then, the median sale prices recorded in 2012 have exceeded the 2011 levels every month, according to the Residential Real Estate Price Report Index, a monthly analysis of the 13-county metro area prepared by the Shenehon Center for Real Estate at the University of St. Thomas’ Opus College of Business.

Each month the center tracks nine housing-market data elements, including the median price for three types of sales: nondistressed or traditional-type sales, foreclosures, and short sales (when a home is sold for less than the outstanding mortgage balance).

The overall median sale price for all categories of homes in the Twin Cities peaked at $238,000 more than six years ago, in June 2006. That overall median price hit its low point in February 2012 at $138,250.

Herb Tousley, director of real estate programs at the university, said housing data from December “continues to exhibit many of the positive market trends that have been observed for much of 2012.”

The median sale price in December 2012 for all categories of homes was $168,404, a gain of 16.2 percent over December 2011 when it was $145,000.

The median price of a nondistressed home in the Twin Cities peaked in June 2006 at $239,900 and reached its low point in February 2012 at $180,000. Since last February the median price for these traditional home sales increased steadily until peaking in August 2012 at $219,700. The median price then began its seasonal, fourth-quarter decline, ending at $208,000 in December 2012. That was a 9.2 percent increase over December 2011.

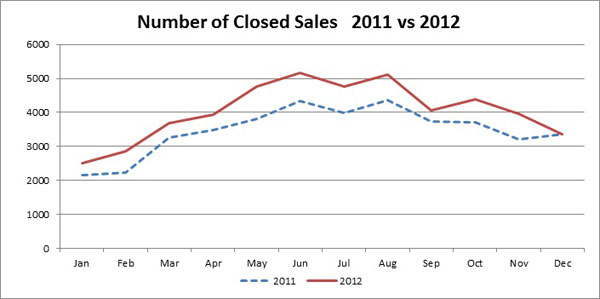

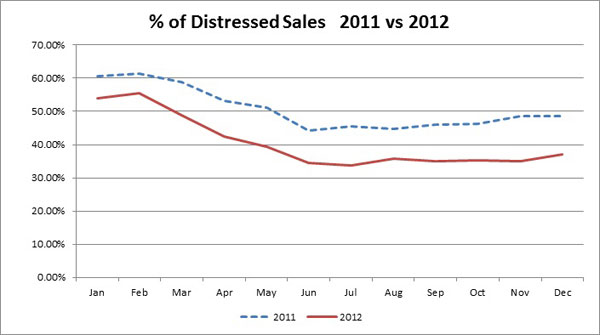

Tousley said the volume of closed sales in December 2012 was 3,380, which was almost identical to December 2011. The difference, he said, was that only 38.6 percent of the homes sold in December 2012 were distressed properties (foreclosures and short sales) compared to 50.2 percent in December 2011.

St. Thomas uses sale price and other data elements to create a composite index that tracks the health of the traditional, foreclosure and short-sale markets. When comparing 2012 to 2011, the traditional-sale index is up 10 percent, the foreclosure-sale index is up 13.5 percent, and the short-sale index is up 7.4 percent.

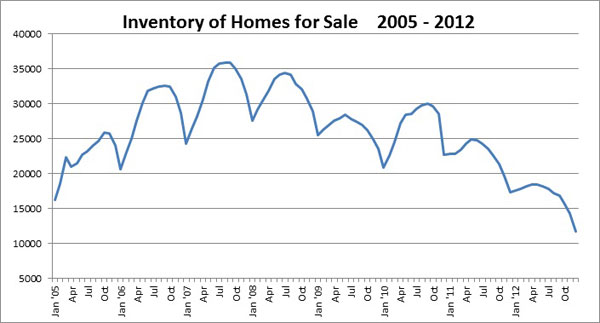

The inventory of homes on the market remains at historically low levels. There were 11,842 Twin Cities homes for sale in December 2012, down from 17,416 the previous December. Also compared to a year ago, the number of pending sales was up 6.7 percent and the number of new listings was down 15.5 percent. “This suggests that the number of homes on the market will continue to be very low for the next several months,” Tousley said.

“2012 also will be noted as a year when the inventory of homes for sale declined to unprecedented low levels,” he said. “The fact that many homeowners were under water or had little equity in their homes, along with feelings of general economic uncertainty, kept many homeowners who normally would be sellers on the sidelines.”

Tousley points to factors now in place that will lead to higher median prices, more homes on the market, an increase in new construction and fewer foreclosure and short sales. His point-by-point analysis:

- Interest rates are expected to remain at their current extremely low levels during 2013. Low interest rates, a shortage of homes for sale, and generally improving economic conditions will continue put upward pressure on median sale prices through spring and summer.

- The median sale price of all types of homes should continue to show healthy year-over-year increases for the first half of the year. As home prices continue to increase, homeowners’ equity positions will continue to improve and more homes will be put on the market, increasing the supply of available homes.

- As the supply of homes increases and the shortage abates, the market should become more balanced. Once this happens prices will continue to increase, although at a slower rate. Look for annualized, median price increases of 2 percent to 3 percent in the second half of 2013.

- The number of foreclosures and distressed sales will continue to moderate in 2013. The percentage of distressed sales should fall into the 25 percent to 35 percent range in comparison with the 35 percent to 55 percent range that was observed in 2012.

- The shortage of homes for sale coupled with an increase in the rate of household formation that comes with an improving economy will continue to create opportunities for home builders. New construction of both multifamily and single-family homes should continue to increase throughout the year with 2013 bringing much-needed relief to home builders and the construction industry.

More details about the market can be found on the Shenehon Center’s website.

Research for the monthly reports is conducted by Tousley and Dr. Thomas Hamilton, associate professor of real estate at the university. The index is available free via email from Tousley at hwtousley1@stthomas.edu.