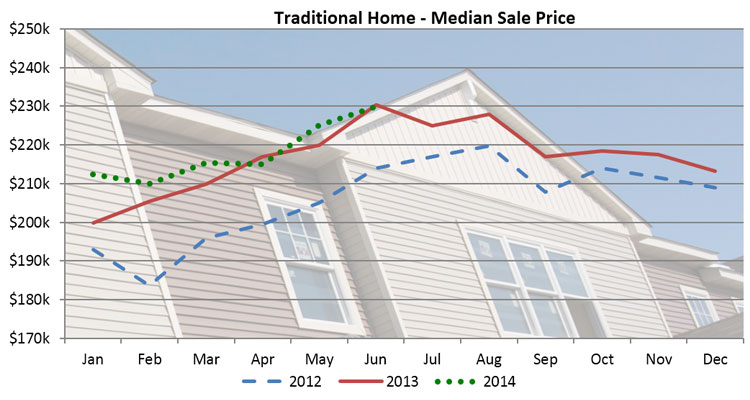

The housing market in the Twin Cities continues to try to make up for a slow start during the first half of the year, according to research from the Opus College of Business' Shenehon Center for Real Estate. There are several key indicators that are indicating a return to normal market conditions. Overall median sale prices are up nearly 5% compared to a year ago and the median sale price of a non-distressed home is approaching pre-crash levels. Although a 5% increase is less that the double digit gains seen in the previous two years, it is a much healthier, sustainable rate of growth that will not result in another housing price bubble.

Other positive signs include a significant increase in the inventory of homes available for sale and a large decrease in the percentage of distressed homes that were sold in June. The increase in the number of homes for sale will result in a better balance between buyers and sellers. Buyers will have more choices as the market moves from a seller’s market to a normal equilibrium. The percentage of distressed sales has markedly decreased in the last several months. During the early part of this year the percentage of distressed sales was hovering near 30%. Over the last two months the percent of distressed sales has dropped to 12.7%, a level not seen since mid-2007. More importantly, the number of new foreclosures continues to drop resulting in even fewer distressed sales in the next 12 – 18 months.

The UST Indexes

The UST Residential Real Estate Short Sale Composite Market Health Index was 910 in June, up 14 points from the 896 recorded in May, a 5.4% increase compared to one year ago. Look for the Short Sale Composite to play a less significant role in our analysis as the number of short sales drops below 3% of the total monthly sales.

The foreclosure market’s health as represented by the UST Residential Real Estate Foreclosure Composite Index increased in June, moving from 781 in May to 798 in June, an increase of 2.1%. The index remains 1.6% higher when compared to June 2013.

Have the 25 – 35 year olds changed their outlook on homeownership? This month the Shenehon Center also decided to see if those in the Millennial generation are as interested in homeownership as their Baby Boomer parents. The charts and report for June can be found on the Shenehon Center’s website.

Research for the monthly real estate reports is conducted by Herb Tousley and Dr. Thomas Hamilton, associate professor of real estate at the university.