Leaders in the field of Minnesota commercial real estate are generally optimistic about their industry and economic conditions in general. However, they also have identified some headwinds related to land prices and the cost of building materials.

That is the theme of the ninth Minnesota Commercial Real Estate Survey that was conducted in May. The semiannual poll of 50 Minnesota commercial real estate leaders from the fields of development, finance and investment is conducted by the Shenehon Center for Real Estate at the University of St. Thomas’ Opus College of Business.

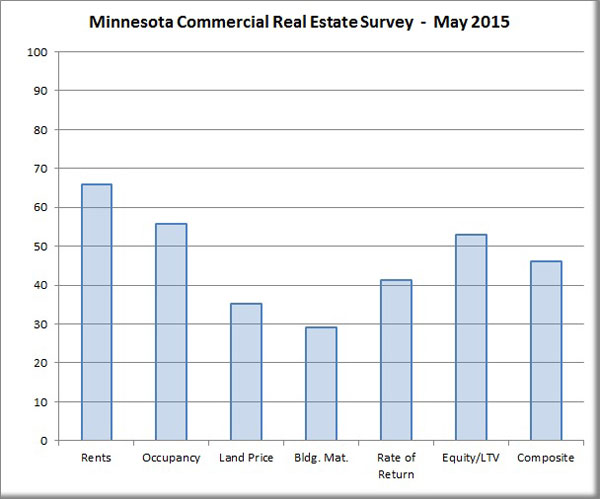

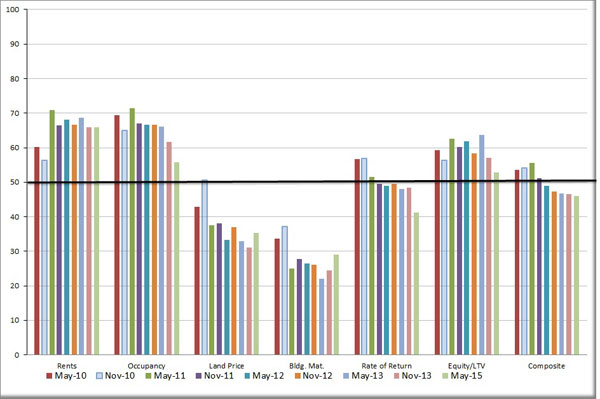

In all nine surveys the same group of 50 industry leaders have been polled on their expectations of future commercial real estate activity. Their responses are used to create index scores that can be compared over time. Scores higher than 50 represent a more optimistic view of the market over the next two years; scores less than 50 represent a more pessimistic view.

The composite score for the May survey stands at 46 and continues a “slightly less-than-neutral” trend for the fifth-consecutive survey.

“This survey’s composite results reflect a mixed bag of optimism in some areas and pessimism in others” said Herb Tousley, director of real estate programs at the university. “This is similar to the pattern that was observed in our previous survey. However, the degree of optimism and pessimism has become slightly more moderate.”

Price for Space

The index score for rental rates remains positive at 66, which Tousley said is “an indication that our panel is still expecting strong rent growth for the next two years.”

The index for occupancy levels moved from 62 to 56. “Despite the decrease, the panelists remain optimistic that rents and occupancy levels will continue to improve,” he said.

This marks the ninth-consecutive survey with positive index scores in these two areas. That indicates, he said, “continued optimism that the economy is going to continue to improve and there will be a continued demand for additional space.”

Land Prices

The panel’s outlook for land prices reveals a strong expectation that land prices will continue to increase. The land-price index increased slightly, moving from 31 in the previous survey to 35 in the May survey.

“Increasing land prices increase total project costs and are a hindrance to new development, making it more difficult to obtain financing and adequate returns for investors,” he said.

Building Materials

The building-material index moved from a negative 24 to a somewhat less pessimistic 29.

“That reflects the panel’s opinion that building-material price increases are expected to moderate sightly,” Tousley said. “A moderation in price increases will be favorable for future development.”

Return for Investors

The index for investors’ returns decreased from an essentially neutral 48 to a more pessimistic 41.

“The consensus of the panel indicates that investors will expect higher returns in two years, leaving less profit for the developers,” he said. “There was a concern that interest rates that have been at record-low levels for the past seven years will be higher two years from now, requiring higher rates of return on future investments.

“Higher interest rates will add to total project costs and higher project costs will squeeze project return on investment. Investors will continue to seek out quality investments but they are being much more diligent about how they price risk and evaluate return when considering their investment options.”

Required Equity

The index for the amount of equity required by lenders dropped from 57 to 53.

“This indicates the panel’s belief that credit will be available for good projects but lenders will increase their equity requirements in the coming two years,” he said.

“This indicates the panel’s belief that credit will still be available for good projects but that lenders will increase their equity requirements in the coming two years. The good news is that more equity should result in better rates and terms; however, the bad news is that in many cases equity is harder to find and more expensive than debt,” Tousley said.

Accuracy

With nine surveys completed since the Minnesota Commercial Real Estate Survey began in 2010, the researchers compared the panel’s past predictions with how things actually turned out.

It turns out that market conditions in May 2015 are very close to what the panel predicted in May 2013. Some examples:

- In 2013 the panel predicted higher rents in 2015. The average net rents for all types of industrial properties in the Twin Cities went from $5.70 per square foot in 2013 to $6.15 per square foot in 2015.

- In 2013 the panel predicted higher occupancy in 2015. The average direct vacancy for industrial properties in the Twin Cities went from 8.1 percent in 2013 to 7 in 2015.

- In 2013 the panel predicted higher costs for building materials in 2015. Although the price for lumber decreased, the Mortenson Construction Cost Index for the Twin Cities increased from 104 in 2013 to 114 in 2015.

Summary

“It appears that our panel’s expectations of higher land costs and the higher cost of building materials are the primary culprits driving the composite index to its slightly below neutral level,” Tousley said.

“Despite the headwinds created by higher project and acquisition costs, the panel has strong expectations that general economic conditions in our area will continue to improve and there will be an increasing demand for space. The demand for more space will put upward pressure on rents. Higher revenues in the form of higher rent will offset most of the much of the expected increase in the price of land and building materials, allowing owners and investors to achieve their required returns and development to move forward.

“Conditions for development and acquisitions have definitely improved since the last survey. Based on the survey results our panel expects that even if interest rates increase modestly, development and acquisition activity will continue at near present levels for the next two years.”

Additional details can be found on the Shenehon Center’s website.