Professional Licensure Disclosures: Accounting

Professional licensure requirements vary from state to state. Students who intend to pursue professional licensure outside of the State of Minnesota should contact the appropriate agency to seek guidance and information confirming licensing requirements.

Students should be aware that licensure requirements are subject to change periodically and may include educational or degree requirements, professional examinations, background checks, character and fitness qualifications, work experience, fingerprinting, and other requirements.

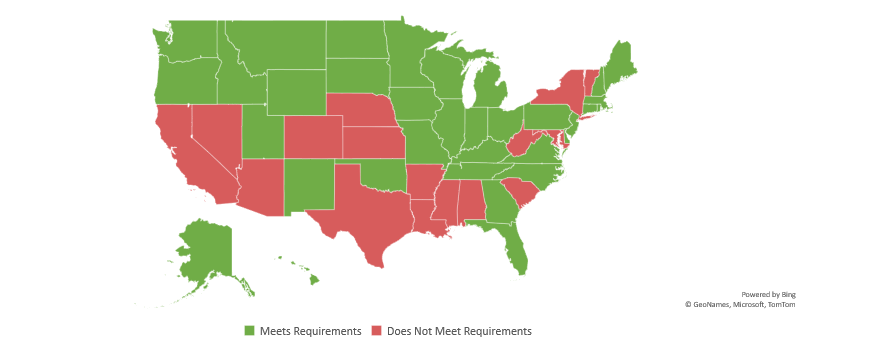

The University of St. Thomas studies in accounting prepare students to sit for the Certified Public Accountant (CPA) exam in 38 states; 17 states require coursework outside the St. Thomas degree plan.

Contact Information

Kristine DeVinck

Professor of Accounting

kmdevinck@stthomas.edu

Professional Licensure Disclosures by State

Program Information: Bachelor of Arts (BA) in Business Administration with a concentration in Accounting

Date Updated: 06/08/2021

Meets Requirements: AK, CT, DE, District of Columbia, FL, GA, HI, IA, ID, IL*, IN, KY, MA, ME, MI, MN, MO, MT, NC*, ND, NH, NJ, NM, OH, OK, OR, PA, RI, SD, TN, UT, VA, WA, WI, WY, American Samoa, Federated States of Micronesia, Mariana Islands, Republic of Marshall Islands, Republic of Palau, Puerto Rico, Virgin Islands

*Illinois – student will need to take MKTG 245 as an elective to complete requirement for Business Communication

*North Carolina – student will need electives in 2 of: communications (4 credits), finance (2 credits), international environment (4 credits), ethics (2 credits)

Does Not Meet Requirements: AL, AR, AZ, CA, CO, KS, LA, MD, MS, NE, NV, NY, SC, TX, VT, WV, Guam